Stablecoins

The Upshot

“The proliferation of dollar stablecoins - rendered possible by the ubiquity of smartphones and the cryptography of blockchains - could become the greatest experiment in financial empowerment humanity has ever undertaken.”

-Ritchie Torres

The Problem

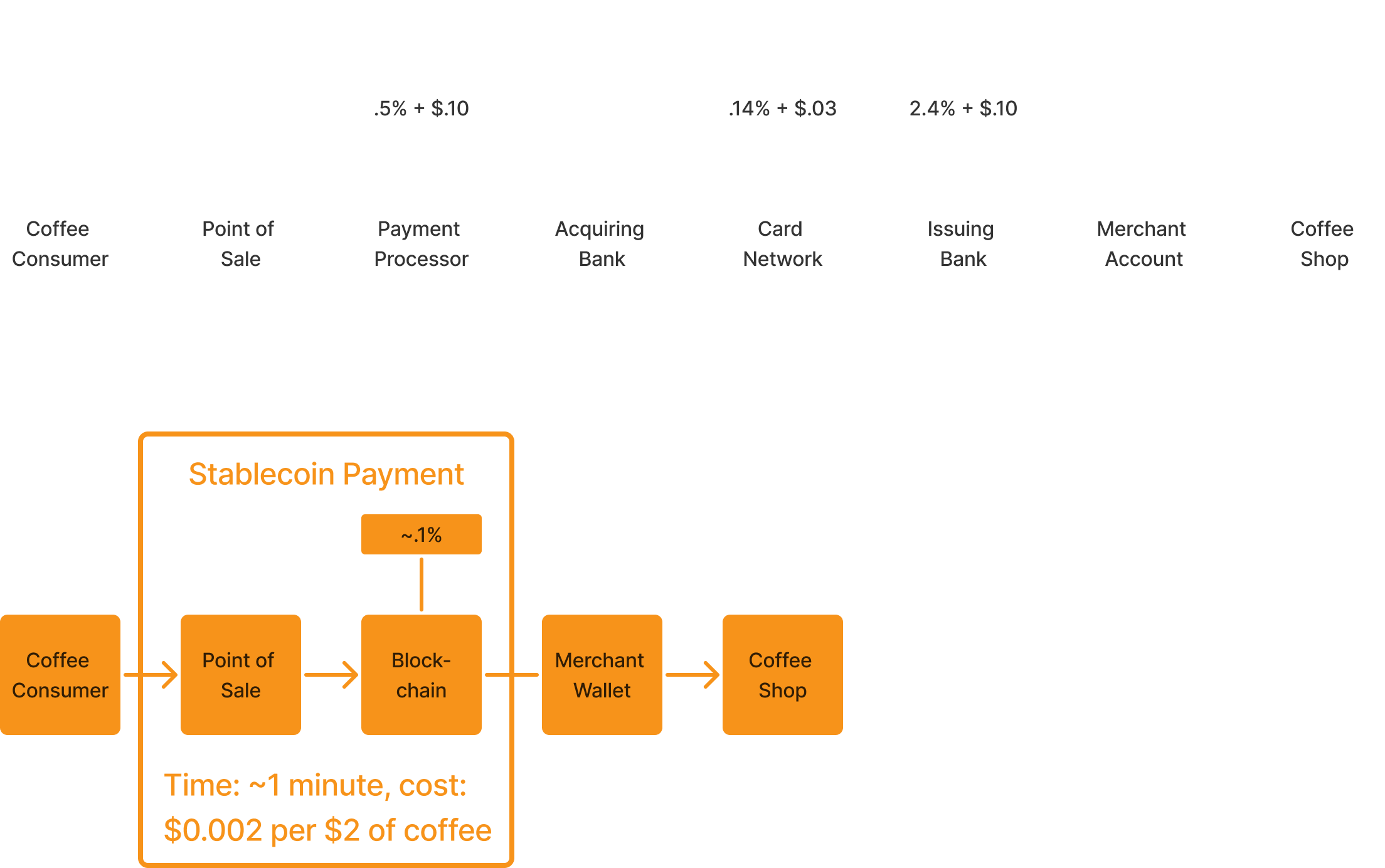

Today's payment landscape, not so efficent. In 2023, the global payments industry processed 3.4 trillion transactions, generating $2.4 trillion in revenue while handling $1.8 quadrillion in value. The cost of this system falls heavily on businesses:

- When customers spend $2 on coffee, the shop only gets $1.70-$1.80 while card companies take ~15% ($0.20-$0.30) just to process the payment

- Walmart's $648B annual revenue yields $15.5B in profit, while paying about $10B (1.5%) in credit card processing fees

- Of Stripe's 2.9% + $0.30 fee per transaction, over 70% goes to Visa and the issuing bank, with Stripe keeping less than 30%

- Sending $200 from US to Colombia costs less than $0.01 using stablecoins, compared to $12.13 through traditional money transfer services

- Kroger's entire profit margin (below 2%) is less than credit card processing fees

- Chipotle pays $148M in credit card fees on $1.2B annual profit

The Solution

While traditional card payments bounce through 6 different companies taking fees over 1-3 days, stablecoins work like handing someone cash over the internet - direct, near-instant transfers for less than a penny.

Sablecoins are cheaper faster money, but cutting out the middle man.

Some Social Proof

- Industry signals: Stripe's acquisition of Bridge.xyz for $1B

- User base: Already 28.5M unique stablecoin users conducting 600M monthly transactions

- Q2 2024: Stablecoin volume hit $8.5T, comprising 32% of crypto transaction volume

- Infrastructure: Layer 2 solutions have reduced transaction costs from $12 to under $0.01 USDC

Adoption Flywheel

Three drivers create a feedback loop accelerating stablecoin adoption:

-

Lower Costs Through Back-Office Integration: Stablecoin orchestration, integrated into payment processors like Stripe, enables businesses to cut costs on payroll, subscriptions, and invoices without major changes to existing processes. These savings cascade to consumers through structurally cheaper products as adoption scales.

-

Shared Incentives and Better Onboarding: Easier onramps (e.g., Venmo, Paypal, Revolut) reduce friction for user adoption, while fiat-backed issuers like Circle, Paypal, and Tether share profits with businesses. This model mirrors how Visa shares fees with partners, enabling businesses to earn yield on stablecoin flows.

-

Growing Trust via Regulatory Clarity: Frameworks like the EU's MiCA regulation provide clear guidance, increasing confidence in stablecoins. MiCA has already reshaped the European stablecoin market. In the U.S., bipartisan interest in legislation focuses on ensuring stablecoin issuers maintain high-quality reserves and meet compliance standards, fostering trust in adoption.

Feedback Loop

- Lower costs (1) incentivize businesses to adopt

- Shared profits and easy onboarding (2) attract users and businesses

- Regulatory clarity (3) reinforces trust, validating stablecoins as reliable solutions

- Result: Each new participant strengthens the ecosystem, compounding adoption

Banks and Stablecoins

Historical Milestones

From the First Bank to USDC, financial systems tackle trust and scale. The timelines show how stablecoins compress centuries of banking evolution into years.

Traditional Banking

[1791-2020]

Stablecoins

[2014-2025]

First Bank of the United States: First centralized authority for standardizing national currency redemption (Americas Bank)

USDC launches: First major US-regulated stablecoin with standardized redemption

Second Bank: Expanded standardized bearer instruments for national trade

Sky Protocol (MakerDAO): Introduces decentralized overcollateralized lending

Free Banking Era: Multiple private banknotes with varying trust and redemption values

Fiat-backed stablecoins: Regular audits and redemption guarantees established

National Banking Era: Unified greenback) redemption standard established

Asset-backed stablecoins: Transparent collateral and liquidation protocols mature

Federal Reserve Act: Created fractional reserve banking enabling money creation through lending

Proof of Reserves: zkTLS verification enhances transparency

FDIC Creation: Guaranteed deposit safety through federal insurance

SEC enforcement: Regulation of synthetic dollar products begins (TrustToken Inc. and TrueCoin LLC)

End of Gold Standard: Transitioned to pure fiat currency system for money creation

Market Dominance: Fiat-backed stablecoins reach 94% of total supply

Volcker Rule: Separated retail banking from speculative investment to reduce systemic risk

Lending Evolution: Decentralized protocols expand money supply capabilities

Zero Reserve Requirements: Maximized fractional reserve lending flexibility under regulation

Full Maturity: Stablecoins establish robust regulatory and technical standards

I'd say the main takeaway here is that: Stablecoins built-in transparency (auditable reserves, visible collateral) enables faster evolution of lending products compared to traditional banking. You can copy what worked in banking, paste it into stablecoins.

Types of Stablecoins

Stablecoins comes in three main flavours: 1) Fiat-backed 2) Asset-backed 3) Synthetic dollars.

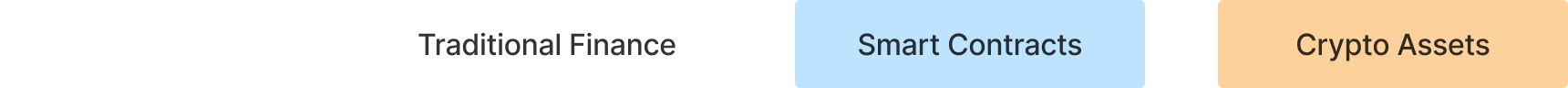

- Fiat-backed: dominate the market ($150B, 94% share), led by Circle (USDC) and Tether (USDT). These tokens function as digital bearer instruments with 1:1 fiat redemption rights, backed by audited reserves of cash and treasuries. While current implementation relies on centralized audits, emerging solutions like zkTLS aim to provide cryptographic proof of reserves.

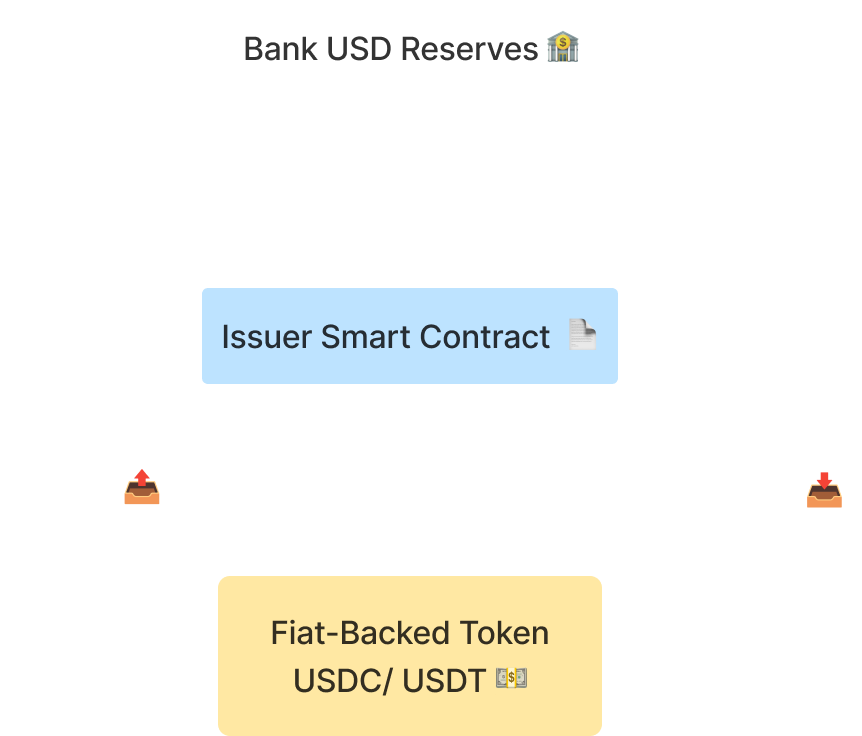

- Asset-backed: are created through decentralized lending protocols like Sky Protocol (formerly MakerDAO), mirroring how traditional banks create money through fractional reserve banking. While banks create most of the M2 money supply through various loans, these protocols generate stablecoins against overcollateralized onchain assets. Unlike traditional banking, asset-backed stablecoins offer superior transparency - users can audit collateral directly through the blockchain. They may also fall outside securities law scope when using purely digital collateral managed by autonomous protocols rather than intermediaries. However, adoption remains limited while these protocols mature and establish the robustness seen in traditional lending over its 110-year evolution. Key evaluation criteria for lending protocols are: 1) Governance transparency 2) Collateral quality (ratio, volatility, liquidity) 3) Smart contract security 4) Real-time collateralization maintenance

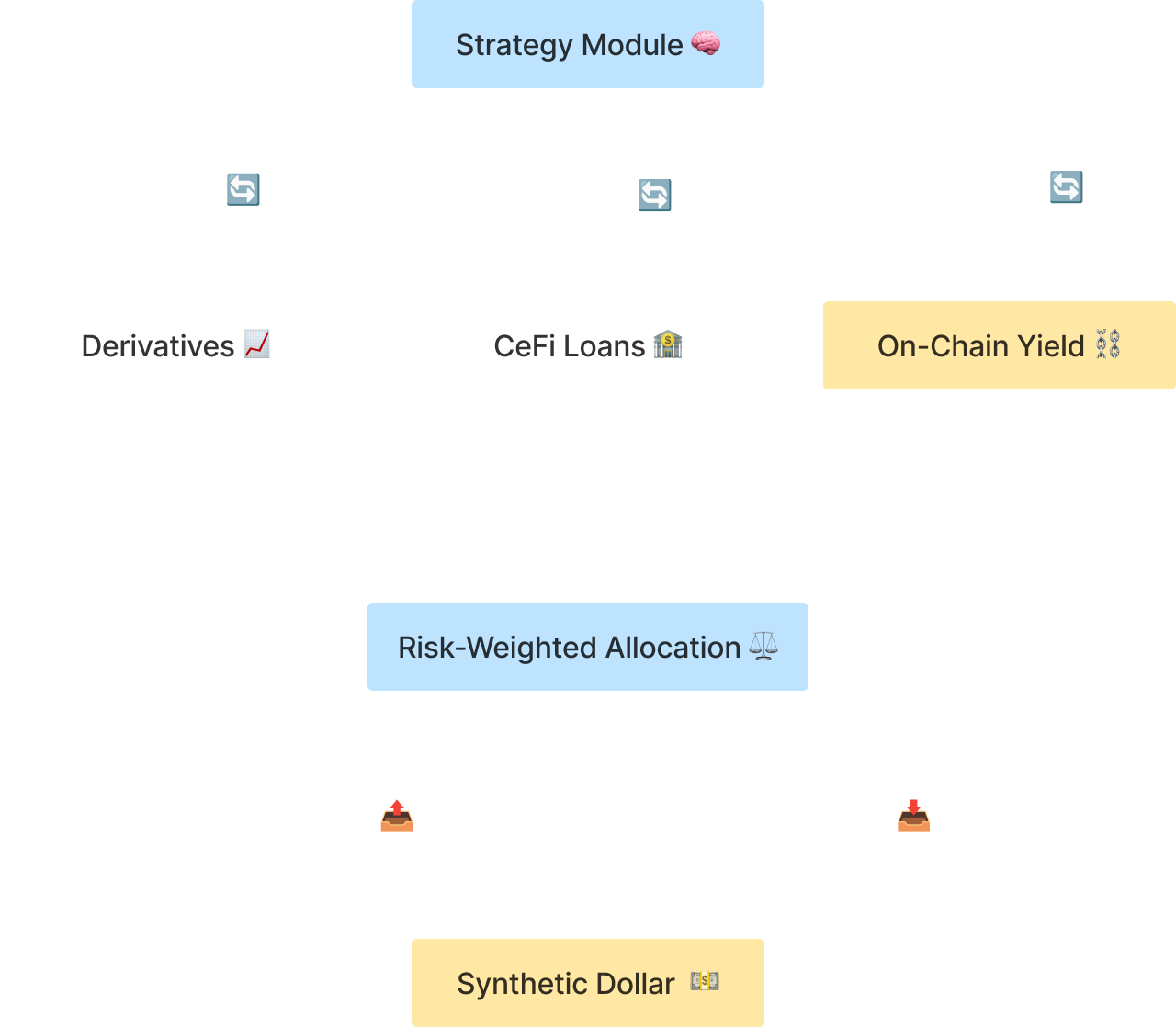

- Strategy-backed: synthetic dollars are not true stablecoins but rather dollar-denominated tokens backed by active trading strategies. They function more like shares in an open-ended hedge fund, utilizing strategies like the basis trade or AVS restaking. Key risks are: 1) Centralized, undercollateralized structure 2) Exposure to CEX risk and market volatility 3) Limited auditability of complex strategies 4) Potential for cascading DeFi failures upon depegging Notable regulatory context: The SEC has taken enforcement action against SBSD issuers, treating them as unregistered investment products rather than stablecoins. Despite yield potential, adoption remains limited due to these concentrated risks, which exceed typical bank deposit risk profiles.

I'm focusing on fiat-backed stablecoins, particularly USDC, because their regulated, fully-audited approach and market leadership puts them in a unique position to reshape institutional finance for most of this writing.

Five Takes on Stablecoins and What They Mean

Regulator Views

- Grey: Ban them - they're unregulated bank deposits needing oversight

- Gorton & Zhang: They can't work, won't work, violate monetary principles

- Massad: Must regulate them to protect sanctions power, but can't ignore them

- Waller: Good for dollar dominance, 99% are USD-pegged

- Brooks: Key to maintaining USD reserve status, expand dollar's reach

There is an expanded table in the Appendix.

My Takeaway

Stablecoins have evolved beyond their $160B float and 80% settlement dominance to reshape global finance in fundamental ways. Stablecoin issuers now effectively operate as private Federal Reserves, with their treasury management and yield distribution decisions directly impacting DeFi liquidity and monetary conditions throughout the ecosystem. This shift has created an infrastructure control paradox: as stablecoins become more systemically important, traditional regulatory control mechanisms prove less effective against decentralized protocols and cross-chain bridges.

The technology simultaneously strengthens and weakens dollar hegemony by driving dollarization in markets like Argentina, Turkey, and Nigeria while creating a "shadow Eurodollar" system that operates outside U.S. oversight. This has produced a more powerful but less controllable global dollar system. Despite on-chain transparency, monitoring complexity has increased as tokens can be locked, wrapped cross-chain, and used as collateral across multiple protocols, making individual transaction visibility insufficient for understanding systemic risk.

Perhaps most significantly, stablecoins have created unofficial Federal Reserve swap lines from the bottom up, allowing local exchanges to function as offshore dollar banks providing crisis liquidity without official oversight. This represents the emergence of a parallel monetary system operating under fundamentally different rules, challenging traditional regulatory and policy frameworks in ways that extend beyond simple market infrastructure changes.

Market Research

Stablecoins have found product market fit and are the bedrock of today’s crypto infrastructure. I’ve sung their praises, but I do not want to be so dogmatic. I’ve spent a few days reading reports from other stablecoins in the industry (full doc here) and its not all roses and rainbows.

I've tried to come to my own conclusions about the market based on quantitative data and yet to have found anything too novel.

The stablecoin market is expanding quickly, but rapid growth hides serious risks. Tether leads in market cap despite a low safety score due to opaque reserves, reliance on a few banks and custodians, and vulnerabilities in its oracle and governance systems. By contrast, USDC benefits from regulated fiat backing, clear cash and Treasury holdings, and regular audits. For Circle, the priority should be to diversify banking partners, implement risk-monitoring tools like a Composite Health Index, and set up early-warning systems. In short, as the market booms, real stability depends on effectively managing these hidden risks.

Historical Studies

Terra Collapse

Terra’s algorithmic UST, backed solely by its sister token LUNA, imploded and wiped ~$60B in value. Possibly driven by a quant shop shorting LUNA and arbitraging UST during the depeg.

Anchor Protocol

Anchor funneled 75% of UST’s supply by offering a 20% APY and net 121.5% APR for borrowers via token incentives (Decrypt, Forum). With deposits surging 3,826% (June 2021–May 2022) as borrowing demand collapsed, the model became unsustainable. Had borrowing stayed above 50%, Terra might’ve softened the blow.

Events

In April 2022, switching from Curve 3pool to 4pool created severe liquidity gaps. On May 7, Terraform Labs withdrew 150M UST from 3pool, triggering a coordinated attack that saw an 85M UST wormhole bridge transfer and seven key wallets-one offloading 347M UST (Chainalysis).

The collapse unfolded in three phases (May 8–13):

- ~$3B drained from Anchor pushed UST to ~$0.91 (Nansen).

- 225M UST hit centralized exchanges before trading was halted.

- The burn-mint mechanism expanded LUNA’s supply from 342M to 6.5T tokens (~8,000%+ surge).

The Luna Foundation Guard deployed 80,394 BTC in three tranches (22,189 on May 8, 30,000 on May 9, 28,205 on May 10) to defend the peg. The fallout included ₩48B in losses for 280,000 South Korean investors, an SEC lawsuit against Terraform Labs, and an Interpol Red Notice for Do Kwon. Terra’s on-chain governance lacked real-time crisis controls.

USDC vs. Terra

A sound stablecoin built from first principles mirrors USDC:

- Full fiat backing (not algorithmic)

- No synthetic yields (unlike Anchor’s 20% APY)

- Multiple banking partners (avoiding single points of failure)

- Transparent redemption processes (preventing death spirals)

Circle’s early adoption of these principles proves the model’s durability.

Dashboard

Some Live Data (Work in progress. Powered by CoinGecko)

Appendix

Perspectives

Greyism

Unregulated Deposit Taking → Asset-Liability Mismatch → Run Risk → Crisis → Bailout → Taxpayer Burden. Therefore, Regulate Like Banks Now → Prevent Crisis → Protect Taxpayers

| Bank System Component | Grey's Concern | Market Solution | Real Examples |

|---|---|---|---|

| Deposit Safety | No FDIC protection. | Stablecoins impose self-backing with treasuries to reduce risk. | Tether moved to treasuries, Circle shifted from SVB exposure, PYUSD adopted a NY Trust model. |

| Oversight | No Fed oversight of stablecoin reserves. | Rating agencies and market demand increase transparency. | UST’s collapse prompted stricter models (e.g., BlackRock reserves) and new ratings by S&P, Moody’s, and Bluechip. |

| Systemic Risk | Shadow banking risks from unregulated reserves. | Many stablecoins reduce risk by holding liquid treasuries. | Fed banks’ reserves (Levine), stablecoins mimicking direct treasury holdings for stability. |

| Financial Privacy | Risks to financial privacy from private companies’ compliance. | Targeted enforcement aims to curb misuse while maintaining privacy. | DOJ sanctions (e.g., Tornado Cash), Chainalysis tracking major crimes like the $700M+ Bitfinex hack. |

| Innovation | Stablecoins need regulated banking structures to scale. | Real-world adoption integrates stablecoins into traditional systems. | MoneyGram’s Circle remittances, Visa/USDC integration, PYUSD’s trust model surpassing PayPal security. |

Gorton/Zhang

Gorton & Zhang: Failing NQA → Par value instability → Poor MoE → Reduced adoption → Systemic risk due to reliance on unstable instruments.

| NQA Component | G&Z's Theory (2021 Paper) | Reality | Evidence |

|---|---|---|---|

| Historical Trust | Like failed 1830s-60s free banking (Krugman, Bullard, Warren) | US 'free banking' failed due to forced risky assets and restricted branching. | Scotland: 100+ years stable (Selgin). US failures stemmed from regulation, not free market dynamics. |

| Par Value | Can’t maintain stable value like bank notes. | Arbitrage keeps stablecoins at par. | Global markets with millions of users. |

| Due Diligence | Users must verify reserves. | Users transact without checking reserves. | Used globally as a dollar substitute. |

| Crisis Resilience | Past instability proves future failure. | Stablecoins adapted during crises, unlike banks. | Banks failed in 2023; stablecoins improved reserves. |

| Asset Quality | Like risky bank assets. | Backed by liquid Treasuries, with global users. | Regional banks are vulnerable to local risks; stablecoins diversify globally. |

Massadism

Stablecoins resemble Eurodollars → Operate offshore → Weaken US leverage → Threaten sanctions enforcement → Drive global adoption → Increase systemic risk. Therefore: Regulate onshore → Maintain US oversight → Balance enforcement, innovation, and privacy.

| Stablecoin Component | Massad's Concern | Proposed Solution | Illustrative Examples |

|---|---|---|---|

| Resemblance to Eurodollars | Stablecoins, like Eurodollars, enable offshore dollar transactions outside the banking system. | Monitor systemic risks while recognizing structural similarities to Eurodollars. | Eurodollars grew during the Cold War due to offshore demand; stablecoins emerged after crypto debanking. |

| US Control | Stablecoins bypass US banks, reducing US enforcement leverage compared to Eurodollars. | Regulate onshore issuers to preserve oversight and enforcement capabilities. | Eurodollars clear through US banks, maintaining control; stablecoins like Tether avoid this by operating offshore. |

| Sanctions Enforcement | Illicit flows are minor but could grow with stablecoin adoption. | Develop policies that balance compliance with innovation to ensure sanctions are enforceable. | Current illicit flows are limited but could expand if unchecked (Brookings article). |

| Global Competition | Jurisdictions’ positive regulation risks sidelining US influence in stablecoin policy. | Engage globally to ensure the US remains competitive and influential in regulation. | The EU is advancing frameworks such as MiCA to promote stablecoin adoption (Brookings article). |

| Balanced Regulation | Overregulation could harm privacy and stifle US innovation. | Strike a balance between enforcement tools and protecting constitutional privacy rights. | Combining illicit activity detection with privacy protections can avoid overreach (Brookings article). |

Wallerism

Stablecoins dominate crypto transactions → 99% are USD-pegged → Reinforce dollar’s global role → Expand dollar reach via crypto-dollarization → Displace weaker fiat currencies. Therefore: Leverage stablecoins to strengthen USD dominance → Ensure compliance and oversight → Mitigate risks to the dollar system and domestic banking.

| Component | Market Data | Strategic Implications | Risk Factors |

|---|---|---|---|

| USD Dominance | 99% stablecoin market dollarization (Castle Island data, 2024); >80% of blockchain settlement volume (Coin Metrics, 2024) | Strong network effects favor USD-pegged products; minimal multi-currency demand (Federal Reserve speech) | Regulatory pressure for non-USD alternatives (EU MiCA Framework) |

| Global Distribution | Growing emerging market adoption; real-time treasury yield distribution (Federal Reserve speech) | Opportunity in underserved banking markets (Brookings article) | Emerging market restrictions on stablecoins (e.g., Nigeria ban on crypto exchanges). |

| Banking Integration | Direct USD distribution bypassing correspondent banking (Federal Reserve speech) | Growing institutional adoption potential | Bank disintermediation concerns (Brookings article) |

| DeFi Integration | $160B total stablecoin float (Coin Metrics data, 2024) | Core infrastructure position creates sticky demand | DeFi under increased scrutiny in the US; potential tax liabilities create adoption hurdles (Brookings article) |

| Compliance Framework | Stablecoins increasingly adopting KYC/AML frameworks to align with global compliance (Bits on Blocks) | Competitive advantage from strong compliance | Rising compliance costs (Federal Reserve speech) |

Brooksism

$160B stablecoins → 99% USD-denominated → Expand dollar dominance in digital/emerging markets → Drive crypto-dollarization (e.g., Venezuela, Nigeria) → Boost US debt demand via Treasury-backed reserves. Therefore: Leverage stablecoins to reinforce USD dominance → Regulate for compliance → Mitigate banking and trade risks.

| Component | Observations | Strategic Implications | Limitations |

|---|---|---|---|

| Dollar Proliferation | $160B stablecoin market, 99% USD-denominated (Castle Island data) | Expands USD dominance to digital/emerging markets | Small vs sovereign Treasury holders (Japan $1.1T, China $0.85T) |

| Debt Servicing | Short-term Treasuries/repos backing creates US debt buy pressure | Reduces US debt servicing costs, eases deficit financing | Only 47 bps of US government debt; dwarfed by larger holders (Messari Mainnet talk, 2023) |

| Crypto-Dollarization | Growing in Venezuela, Argentina, Turkey, Nigeria; accessible via OTC networks and exchanges | Enables USD access bypassing local banking | Regulatory barriers (e.g., Nigeria's crypto bans) limit adoption |

| Role in Crypto Ecosystem | 70-80% of on-chain value settled (Token2049) | Primary MoE, collateral, settlement layer; new stables offer treasury yields, enhancing adoption | Future non-USD stables (e.g., Ethena) may reduce USD demand |

| Broader Dollar System | Benefits US policymakers, financial elites, sanctions enforcement | Extends US financial oversight globally | Requires trade deficits, hurting US industry (Lyn Alden) |